Stability Platform

Asset management, liquidity mining and yield farming platform.

Users invest funds to vaults that are created by other users. Vaults use tokenized developed asset management strategy logics.

DAO

Info

Asset management

Decentralized finance

DeFi (or "decentralized finance") is an umbrella term for financial services on public blockchains, primarily Ethereum. DeFi is global, peer-to-peer, pseudonymous, flexible, fast, open to all, and transparent. This is a good place for financial assets that, if properly managed, can be multiplied.

Protocols

The DeFi space provides many opportunities to generate returns. Asset management protocols allow investors to leverage these opportunities. The most effective types of such protocols these days are yield aggregators and one-stop platforms.

Yield aggregators automate the process of generating profit and reinvestment, while one-stop platforms allow asset managers to work together with investors. The Stability Platform tries to cover both of these types of capabilities, combining and complementing them with other features.

Sources of profit

If we consider the main sources of income in DeFi that are used in asset management, then these are:

- Supply income and rewards on lending and collaterized debt protocols (CDPs)

- Swap fees in decentralized exchanges (DeXs) for liquidity providers

- Liquidity farming rewards (farms, gauges)

- Asset price growth

In recent years, profitability in lending and CDP has been low, but profitability in the area of liquidity provision has been consistently decent. Investing in assets and waiting for crypto prices to rise also goes well with making money by providing liquidity.

As a result, liquidity mining and related tasks are the core work of a modern asset management protocol.

Liquidity mining

The platform is designed for the rapid development, deployment and maintenance of high-yield DeFi liquidity mining strategies.

Concentrated liquidity

Due to the highest efficiency of use, concentrated liquidity displaces other liquidity pool implementations. Decentralized exchanges (DeX) integrating concentrated automated market makers (CAMM), active liquidity management protocols simplifies incentivization. Market makers and yield farmers use it.

There is no single or best strategy for managing concentrated liquidity. Different strategies are used for different types of token pairs, tasks, and goals. Our platform makes it easy to develop, deploy and maintain a working strategy and share allocation vault for a concentrated liquidity position.

Other liquidity types

In addition to the concentrated liquidity pool, platform can be used for building of liquidity mining solution for a classic pool (UniswapV2 based), a stable pool (curve, balancer, solidly), a weighted pool, a pool of 3 or more tokens, and others. Also, assets can be provided not to the AMM pool, but to the lending protocol in the form of a single token. To manage and work with such positions on our platform, the solution can be implemented quickly.

Yield farming

Usually the rewards in farms and gauges are finite. Profitable farming in any pool is temporary. And in order not to lose money when working with volatile assets, you need to track the position value, profitability, compound profits and constantly look for new sources of income. The platform helps simplify and partially automate this process for farmers. And also to involve developers of current farming strategies in their work, rewarding them.

Active liquidity management

Fungible tokenization of a unique concentrated liquidity position and its automatic rebalancing is a modern way to run successful liquidity mining campaigns. Based on the platform, it is possible to implement and deploy various active management strategies, covering any needs of market makers.

Vaults

The DeFi vault is an asset management service that automatically optimizes the return on your contributed funds. Vaults aggregate user funds into pools, reducing overall transaction costs and optimizing returns for each pool participant. Vault is ERC-20 token.

Our universal vault implementations allow users to create and use a variety of vaults for different purposes.

Vault types (contract)

Compounding (CVault)

Tokenized auto compounding vault with a single underlying liquidity mining position. All income is automatically reinvested.

Token holder is not required to take any action other than deposit or withdraw funds.

Rewarding (RVault)

Vault with claimable rewards, buy-back reward token (BB-token) and initial boost rewards. All income is swaped for BB-token. Initial boost rewards must be more then $30 per day between 30 days. Rewards are distributed by vesting with 7 days duration for buy-back token and 30 days for boost reward tokens.

Rewarding Managed (RMVault)

Coming soon

In addition to the functionality of the Rewarding vault, this one has additional capabilities that can be managed by the owner of the VaultManager NFT.

Managed Strategies

Only managed vault can work with managed strategies.

Changeable compouding ratio

Depending on the ratio, part of income is reinvested, the other part is paid out to investors in the form of BB-token.

Changeable buy-back ratio

Depending on the ratio, part of BB-token rewards is obtained by swapping into the BB-token, the other part is paid from the vault balance, which is received directly from the user creating the vault (project owner, market maker etc). In the second case, the earned assets themselves are sent to the owner of VaultManager NFT, which he can dispose of at his own discretion.

Changeable capacity

The vault manager can limit the maximum total supply of vault shares.

Adding boost reward tokens

New allowed boost reward tokens can be added with custom vesting duration.

DeFi integrations

This type of vault is suitable for integrations with changing the rewards recipient. Can be used for auto-bribing etc.

Rewarding Investor-managed (RIMVault)

Coming soon

Decisions to change parameters are made collectively by vault users through on-chain voting.

Splitter

Coming soon

The splitter vault invests funds into a group of other vaults within specified proportions.

Cross-chain

Coming soon

Cross-chain vault invests funds into a set of vaults from different networks.

Automatic managed

Coming soon

Vault and strategy parameters are changed automatically using a special management strategy.

Strategies

Using the Stability platform, strategies for managing funds, liquidity mining and yield farming of any level of complexity can be implemented in a short time using a minimum of resources. Strategy developer's rights are tokenized into StrategyLogic NFT that earns revenue share of platform fee.

Implemented

- DQMF DefiEdge QuickSwap Merkl Farm

- CF | Compound Farm

- IQMF | Ichi QuickSwap Merkl Farm

- GQMF | Gamma QuickSwap Merkl Farm

Proposed

- Steer QuickSwap Merkl Farm

- Gamma Retro Boosted Merkl Farm

- Ichi Retro Boosted Merkl Farm

- QuickSwap Static Merkl Farm

- UAF | UniswapV3 Active Follow | issue #10

- UAFU | UniswapV3 Active Fill-Up | issue #9

- UAS | UniswapV3 Active Swap | issue #12

- QuickSwap Active Fill-Up Merkl Farm

- QuickSwap Active Swap Merkl Farm

Assembly

The assembly of a new vault is carried out by the user through the platform user interface.

The starting price of the vault share (1e18 vault tokens) in a new vault is always $1.

There cannot be identical vaults in the system; each created vault can only be unique. The number of vaults that can be created depends on the availability of developed strategies, possible parameters of the strategies, farms, limits on buy-back tokens and which vaults have already been created.

To create any vault, you need ecosystem tokens, and to create a rewarding vault, you also need initial boost rewards.

After creating a vault, you receive a VaultManager NFT, which can be used to receive a portion of the platform's income and manage the parameters of managed vaults and strategies.

Fee structure

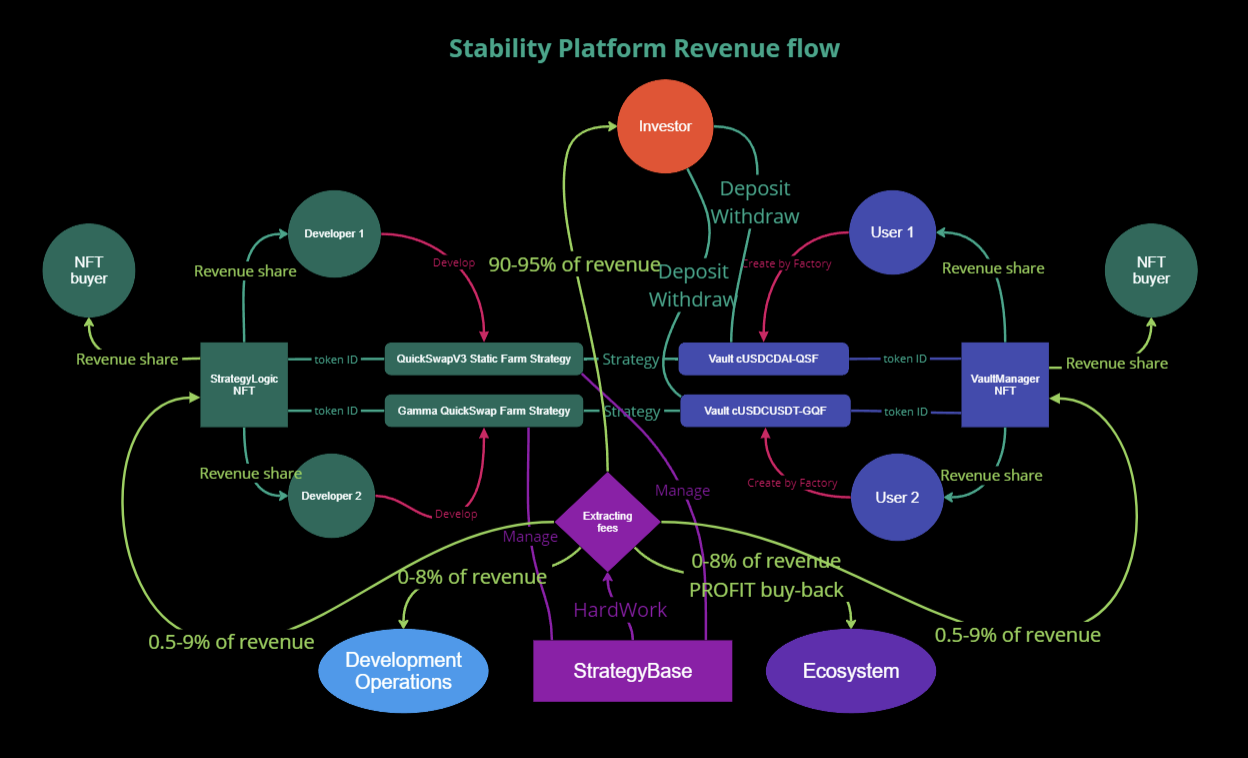

Platform extracts 5-10% fee from vault revenue. Deposits and withdrawals are free.

Depending on results of governance weighted vote, extracted fees go to:

- 10-90%: VaultManager NFT

- 10-90%: StrategyLogic NFT

- 0-80%: Ecosystem (through PROFIT buy back)

- 0-80%: Development and operations

Roadmap

2022

Inception

- PROFIT, SDIV, PM

- On-chain governance V1

- RnD, ReactSwap, DeFi strategies etc

2023

Platform Alpha MVP

2024

Marketing

- Community

- Contest

- defillama

Security

- Bug bounty

- Audit

Strategies

- ALMs Merkl Polygon

- ALMs Merkl Arbitrum

Platform Beta

- User Interface Design

- Smart contracts | Beta meta issue #6

2025+

Platform

- Release

- Splitter vaults

- Cross-chain vaults

- Auto-managed vaults

Bridge

- Smart contracts | Bridge meta issue #7

- User intterface | Bridge page

Tokens

PROFIT

matic:0x48469a0481254d5945E7E56c1Eb9861429c02f44

dexscreener PROFIT/WETH-0.01% on Uniswap V3

Swap by 1inch | Swap by Uniswap V3

Stability. Native Stability DAO ERC20 token.

The total supply of one million tokens has been fairly distributed during the Inception phase between the community, DAO treasury, and protocol owned liquidity.

SDIV

matic:0x9844a1c30462B55cd383A2C06f90BB4171f9D4bB

Stability Dividend. Utility ERC20 token. Used to receive dividends and create vaults.

Minted at constant rate of 1.0 token per block for PROFIT stakers.

PM

matic:0xAA3e3709C79a133e56C17a7ded87802adF23083B

Profit Maker. Utility ERC721 token. Gives 1% of DAO voting power and allows to build 2 vaults per week.

Current total supply: 4 tokens.

Mint price: 10 000 PROFIT.

vePROFIT

Coming soon

With the knowledge and experience gained, we have come to the conclusion that the owners of our DAO should be the owners of the PROFIT liquidity formed in the vaults of the Stability platform.

The underlying token must be the Splitter мault, created with the aim of forming PROFIT token liquidity landscape that is effective for Stability DAO.

Governance

The long-term goal of our decentralized organization is to operate autonomously and develop itself through collective decision-making and management. The final form of governance and voting system that will help achieve the goal is still unknown to us, but we are trying to find it by implementing what we can with the resources that we have.

Treasury and Governance V1

The treasury matic:0xC82676D6025bbA6Df3585d2450EF6D0eE9b8607E contains PROFIT owned by Stability DAO.

During the Inception phase, on-chain Governance was developed that manages the treasury. Voting power is in pure PROFIT and PM. Any owner of tokens, if there is sufficient voting power, can start a new vote on sending funds from the Treasury, arguing their decision in the proposal.

The user interface for voting is Tally.

Multisig

DAO safe matic:0x36780E69D38c8b175761c6C5F8eD42E61ee490E9 is managed by the Stability Builders and is used to pay salaries and other expenses. This address also currently manages the Stability platform, its operators and confirmation of proxy upgrades.

VE-tokenomics and Governance V2

Coming soon

Requirements

- vePROFIT

- Bribes for votes

- Platform fee voting

- Fee distribution wheigted voting

- Allowing buy-back and boost reward tokens voting

- Treasury management proposals

- Verification of weekly reports of salaried employees

Deployments

Polygon [137]

Platform 0xb2a0737ef27b5Cc474D24c779af612159b1c3e60 polygonscan

December 1, 2023